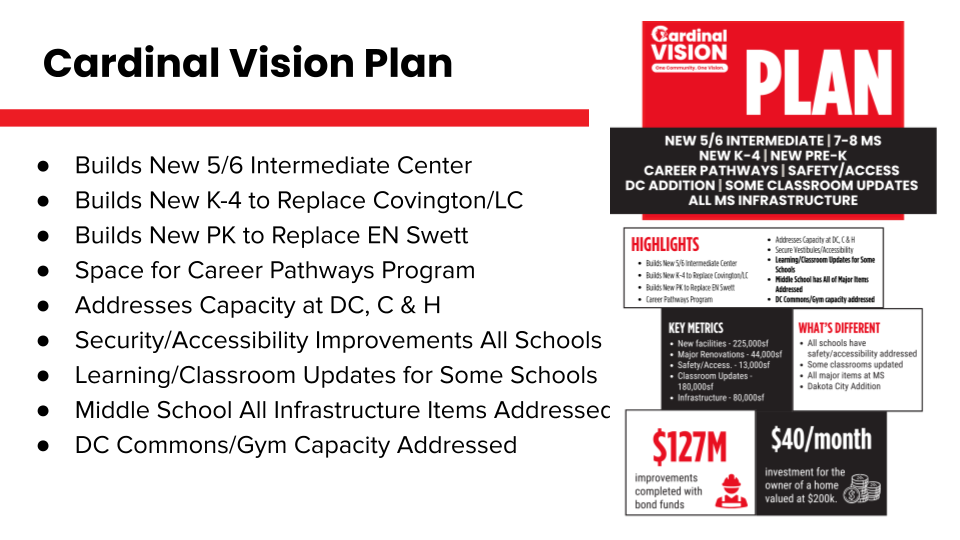

Estimated Project Cost and Taxpayer Investment

The South Sioux City Community Schools bond proposal represents a community investment in modern, safe, and adaptable learning environments. The proposed bond amount reflects a strategic response to growing enrollment, aging infrastructure, and the long-term needs of our students and staff.

Total Proposed Project Cost

$127 Million

This figure includes the full scope of recommended projects: renovations, new construction, safety improvements, infrastructure upgrades, and future-ready learning spaces.

Estimated Taxpayer Investment

If approved, the bond would result in the following estimated cost for a South Sioux City homeowner:

Daily Investment:

$1.31 per dayMonthly Investment:

Approximately $40 per monthAnnual Investment:

Roughly $480 per year

*Based on the owner of a home valued at $200,000. Actual impact will vary depending on the assessed value of individual properties.

Financial Overview:

As part of Community Engagement Session # 3, Director of Facilities and Business Operations Erin Heineman presented key financial insights to help stakeholders understand our district’s current realities and future opportunities. This financial section builds upon “The SSC Story” previously shared by Superintendent Dr. Rony Ortega and reemphasized by Erin Heineman, highlighting the intersection of our growing enrollment, aging infrastructure, and Ensuring Opportunities.

Our Financial Landscape

Revenue and Resources

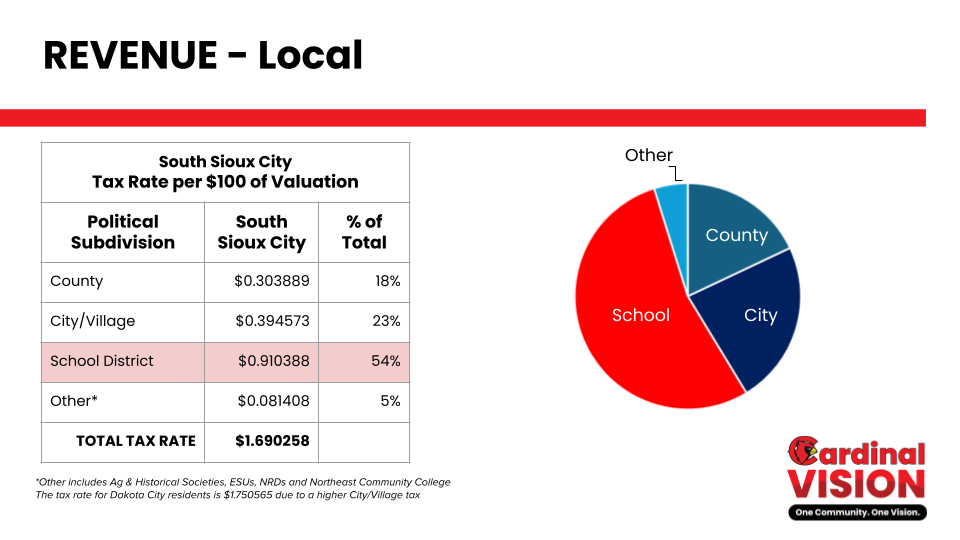

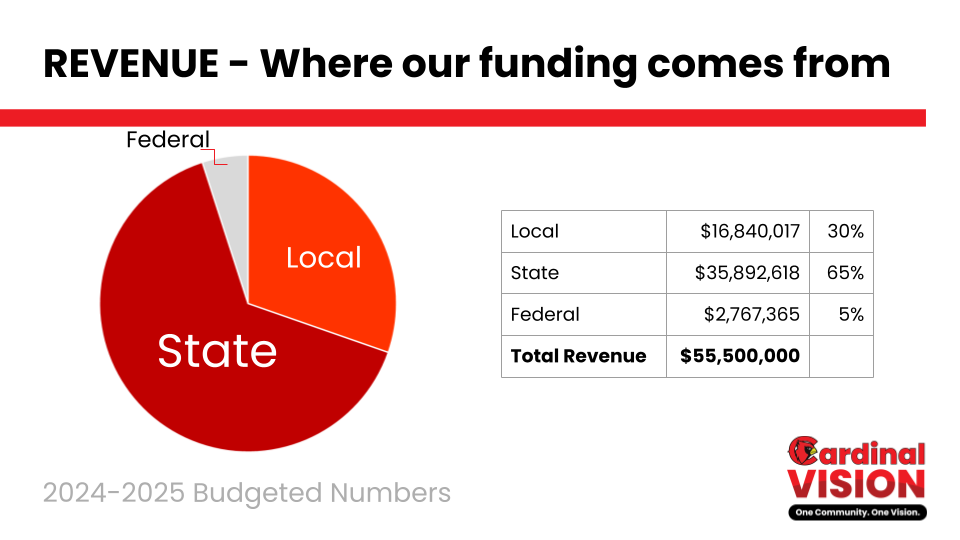

South Sioux City Community Schools operates with an annual budget of approximately $55.5 million, funded primarily through:

State Aid (65%)

Local Property Taxes

Federal Programs

However, our local property tax contributions are constrained by two significant factors:

Low property valuations within the community

Minimal agricultural land in the district’s tax base

As a result, SSC receives only $3,883 per student in local property tax revenue, significantly below the approximately $16,000 required per student annually to support educational needs and facility operations. This discrepancy underscores the financial limitations our district faces compared to other communities across Nebraska.

Expenditure Priorities

Roughly 80% of our annual budget—or four out of every five dollars—is directed toward personnel costs, including salaries and benefits. This investment reflects our commitment to high-quality instruction but also restricts the funds available for building maintenance and facility upgrades.

Only $1.5 million per year is currently allocated to facilities maintenance and improvements—a modest amount considering the scale, age, and demands of our district’s buildings.

Strategic Financial Planning for Facilities

Bond Capacity and Local Funding

SSC’s previous bond issue, approved 25 years ago, was fully repaid in the summer of 2024. With that debt now retired, the district is positioned to responsibly explore a new bond to fund critical facility improvements. Importantly, SSC remains one of the lowest property tax revenue per student districts in Nebraska, despite our increasing student population and facility needs.

Deferred Tax Increment Financing (TIF) Revenue

TIF development has further limited SSC’s ability to capture property tax revenue in newly developed areas. While these areas eventually contribute tax revenue after a 15-year deferral, they currently do not provide funding to support district operations or facility upkeep.

Comparative Challenges

Unlike our neighboring states, including Iowa—where school districts can utilize sales taxes for building projects—Nebraska districts must rely primarily on property taxes and bond referendums. The state aid formula favors high-need districts like SSC, but the absence of alternative funding sources intensifies the challenge of addressing capital improvement needs.